Many people ask, "Does more than one credit card improve my score?" The good news is that having more than one credit card can actually benefit your score. You can enjoy greater flexibility and rewards when you use your credit card. In addition, it can help you manage your debts. Shopping online is easier if you have multiple credit cards. Different cards can be used to track your spending, prevent fraud, and allow you to make purchases.

Multiple credit cards have many benefits

Multiple credit cards will increase your credit limit and reduce your credit utilization. Different cards can offer you different deals and rewards for different types of purchases. A cashback reward card might be a good option if you shop at supermarkets. Travel rewards cards are useful if you often travel for business and pleasure. A backup card can also be beneficial.

You can also save money by switching your balances to other cards. This will increase your credit score and lower your credit utilization. But, you should be aware of any annual fees that may apply.

Multiple credit cards have their down sides

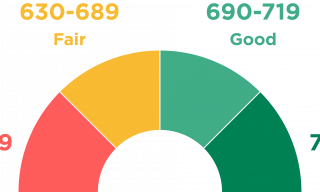

While you may think that having multiple credit cards is a good idea, it can have negative effects on your credit score. You may find that it takes longer for credit scores to improve, especially if your cards are used at the same time. In addition, you may find it difficult to apply for new cards because some companies might not approve you if there are too many credit cards. If you pay your bills on-time, you can expect to see a rise in your credit score.

If you are financially responsible, having multiple credit cards is a good idea. You can take advantage multiple benefits by having multiple credit cards. Only use multiple cards if it is easy to manage. If you're not confident managing multiple credit cards, then you should stick with just one.

Credit scores can be affected by too many credit cards

To improve your credit score, it is important to not use too many credit cards at once. Having too many credit cards makes you appear risky to issuers. This increases your risk of falling into debt and making repeated hard credit check, which can hurt your score. It can also increase your spending, leading to higher debt and missed payments.

The first impact of too many credit cards on credit ratings is their negative impact on your score. A few points can be lost if you have too many credit cards. Your score isn't the only thing it affects. In fact, the number of credit cards you have is only one factor. Using your cards responsibly and making timely payments will help your score.

Another problem with having multiple credit cards is the difficulty of keeping track. Management of multiple cards can be complicated, especially if there are different interest rates or fees. Many premium cards will require an annual membership fee. Some will offer teaser rate introductory offers. It is important to keep track all credit card terms. A high number of credit cards can make you look more risky to lenders.