You might have difficulty deciding whether to have multiple credit cards. It is possible that certain cards have perks that you don't get on others. Having more than one credit card will allow you to enjoy these perks. There is no limit to how many credit card you can have, but if you're organized, it will be easy to manage them.

Benefits

Multiple credit cards can be a great way of spreading the monthly cost of your spending. This allows you to pay your bills promptly and avoid high interest rates. You can also maximize your earnings if you combine rewards cards and other types of credit cards. The average American has 3.84 credit card accounts.

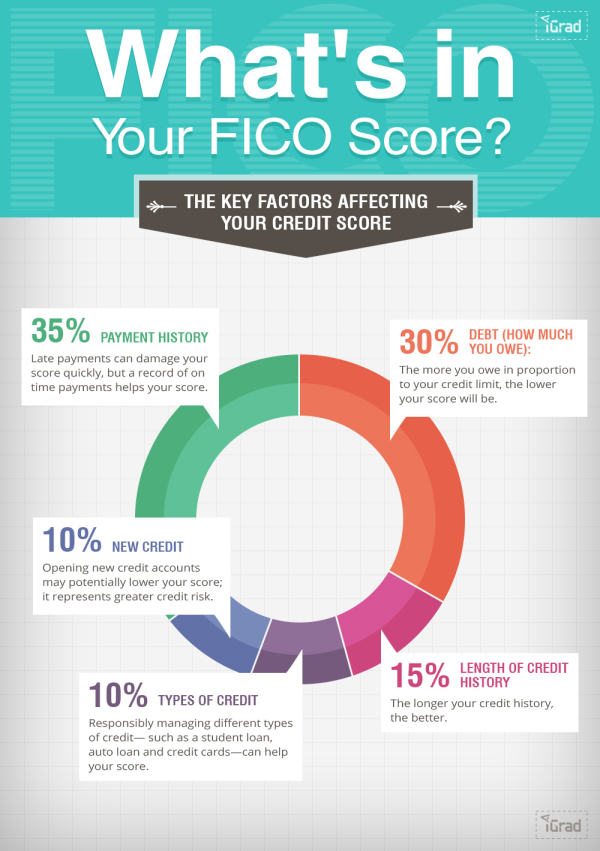

Although having several credit cards may be beneficial to young people, it's not advised for those with poor credit histories. Having several cards can help boost your credit score, but you should make sure to use them responsibly and pay them off in full each month. The ratio of total debt to total credit is a significant factor in determining your credit score. You should aim to keep your credit utilization rate below 30%.

Advantages

Having multiple credit cards is convenient, but it can also be a problem for managing your finances. Some people are able to manage multiple accounts balances with little difficulty. Others get overwhelmed when they receive multiple billing statements. Multiple credit cards can cause more debt.

Although having multiple credit cards increases rewards and cashbacks, it can also make it more difficult to manage them all. You have to keep track of the billing cycles, payment due dates, and credit limits for each card. A missed payment could result in a lower credit score. You may also be more inclined to overspend by having multiple cards. This is a significant risk.

Justification

Multiple credit cards may offer you cashbacks and more rewards than any other card. Multi-card management can be complicated. You need to be aware of payment due dates and credit limits, and you must keep track of your accounts and balances on each card. Missing a payment could negatively affect your credit score. Having more credit cards could also lead to excessive spending, which can result in debt.

A way to avoid this is to limit your credit cards. Other options include paying your credit cards off in full and on a regular basis. This will allow you to avoid paying interest at high rates. In addition, you will have only one card that you can use for business.

Justification to have multiple credit cards

Multiple credit cards can be beneficial, but it can also pose a risk. Different types of credit cards are useful for different purposes. It can help you improve your credit score by keeping track on multiple credit card payments. If you are able to manage the risks and maximize your rewards, multiple credit cards are a great way of managing your finances.

The ability to have more than one creditcard can help you avoid excessive credit utilization. It will also help you to better manage your expenses by avoiding late payments. Keep track of your credit card due dates, and set up automatic payments if you can. As long as you pay your bills on time, multiple credit cards will improve your credit score. By paying your bills on time, you can avoid interest fees and late fees.