When it comes to applying for a loan, your mix of credit is very important. It is best to have both revolving as well as installment credit. You can get revolving debt by opening a card and paying the minimum monthly payments. To avoid interest, charge only what you are able to afford to pay each month. A personal loan is a way to show that you can manage credit in different forms if you don’t currently have any installment loans.

Good credit mix

The good credit mix is not the same for everyone. A good credit mix includes a balance of installment loans as well as revolving credit. But there are many other factors you can do to improve your credit score. These factors include paying your monthly payments on time, avoiding excessive credit utilization and refraining applying for too many credit cards at once.

Your credit history will indicate to lenders that you have a diverse portfolio of accounts. With a diverse credit portfolio, lenders are more likely to approve for credit. That can translate into lower interest rates. Although this factor is not as important as other factors in your credit score, it is still important to maintain a good credit mix in order to be accepted for the best credit offers.

Mix of bad credit and other factors

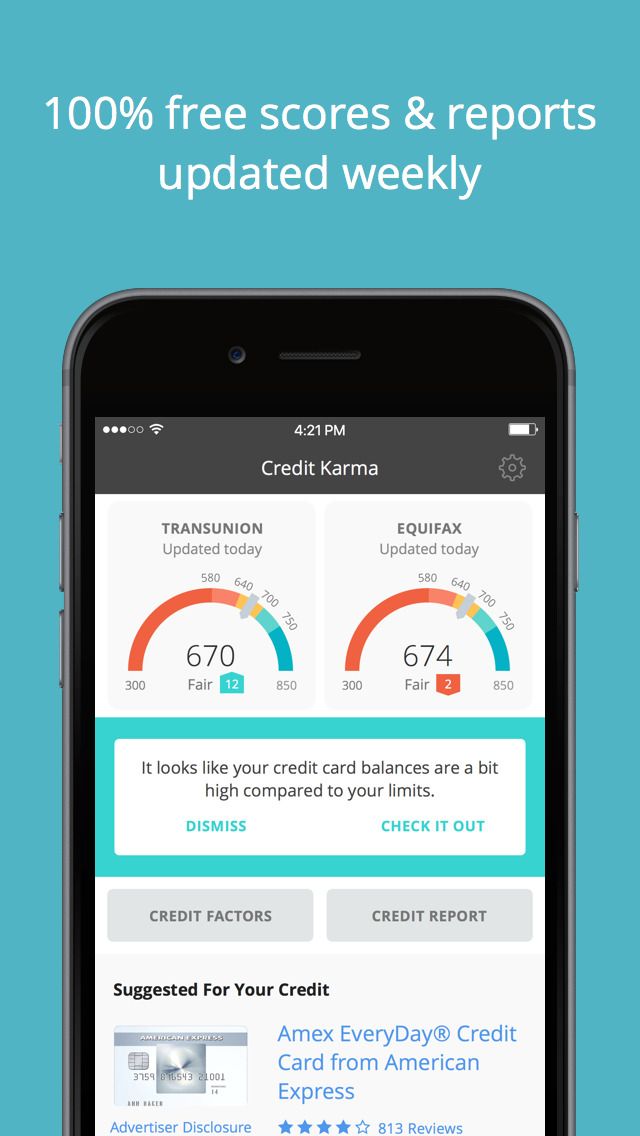

Having a bad credit mix can lower your credit score by up to 10%, and it can cause you to be denied for a new line of credit in the future. Clix Capital, which offers free credit scores checks, is a good place to keep track of credit scores.

Even though poor credit can limit your ability to get traditional loans, there are still ways to build your credit. You can get credit building loans that do not report directly to the credit bureaus unless the payment is late or the loan is sent to collections. These loans can be expensive and could cost you thousands in interest. It is better to improve your credit score by avoiding potential problems before they happen.

Long credit history

Lenders look for long credit histories and credit that includes a variety of credit types when evaluating creditworthiness. This combination shows the lender that you can manage debt and pay your bills on time. Credit mix can be a combination of installment, revolving and mortgage loans.

Another factor is the age of credit accounts. The higher your credit score, the better your credit history. If you close an account recently, it could impact your credit score. A credit report that has been closed for more than 10 years will still show the account, even if it was paid in full.

Credit new

Credit diversity is an important component of your credit score. Your credit score can be affected by different types of credit, such as high-interest credit cards and auto loans. Although it may seem simple, this category has a lot more than meets the eyes. Your score depends on the amount of new and old credit you have and the relationship between those accounts.

An excellent mix of installment credit accounts and revolving credit accounts should be used when building credit. Revolving credit can be used in the easiest way possible. Simply open a credit account and pay the minimum monthly amount. To avoid paying interest, make sure you only charge what you are able to pay every month. If your credit history is limited to revolving credit, it may be worth opening a personal loan. By doing this, you can demonstrate your ability handle multiple types of credit.

Credit utilization ratio

The credit utilization ratio is a measure of how much you owe compared to your available credit. The credit utilization ratio can be calculated by subtracting the total balance from your revolving account and multiplying it by the credit limit. This ratio should not exceed 30 percent. That is, you should pay back more of your credit limits than what you owe.

Credit scores will drop if your credit utilization ratio is high. Similarly, a low credit utilization ratio is better for your credit score. Schulz states that credit card customers should have a utilization ratio less than 30%. This is the threshold below which credit cards can start to negatively impact credit scores. You should limit your credit card usage to $300 per month if it has a $1,000 limit.