Some people are concerned about the impact that Credit Karma can have on their scores. This service can use your credit history in order to place advertisements. These advertisements are similar to those on Facebook. There are several things you can do if Credit Karma is threatening to lower your score.

VantageScore, a scoring model developed by credit bureaus, is available.

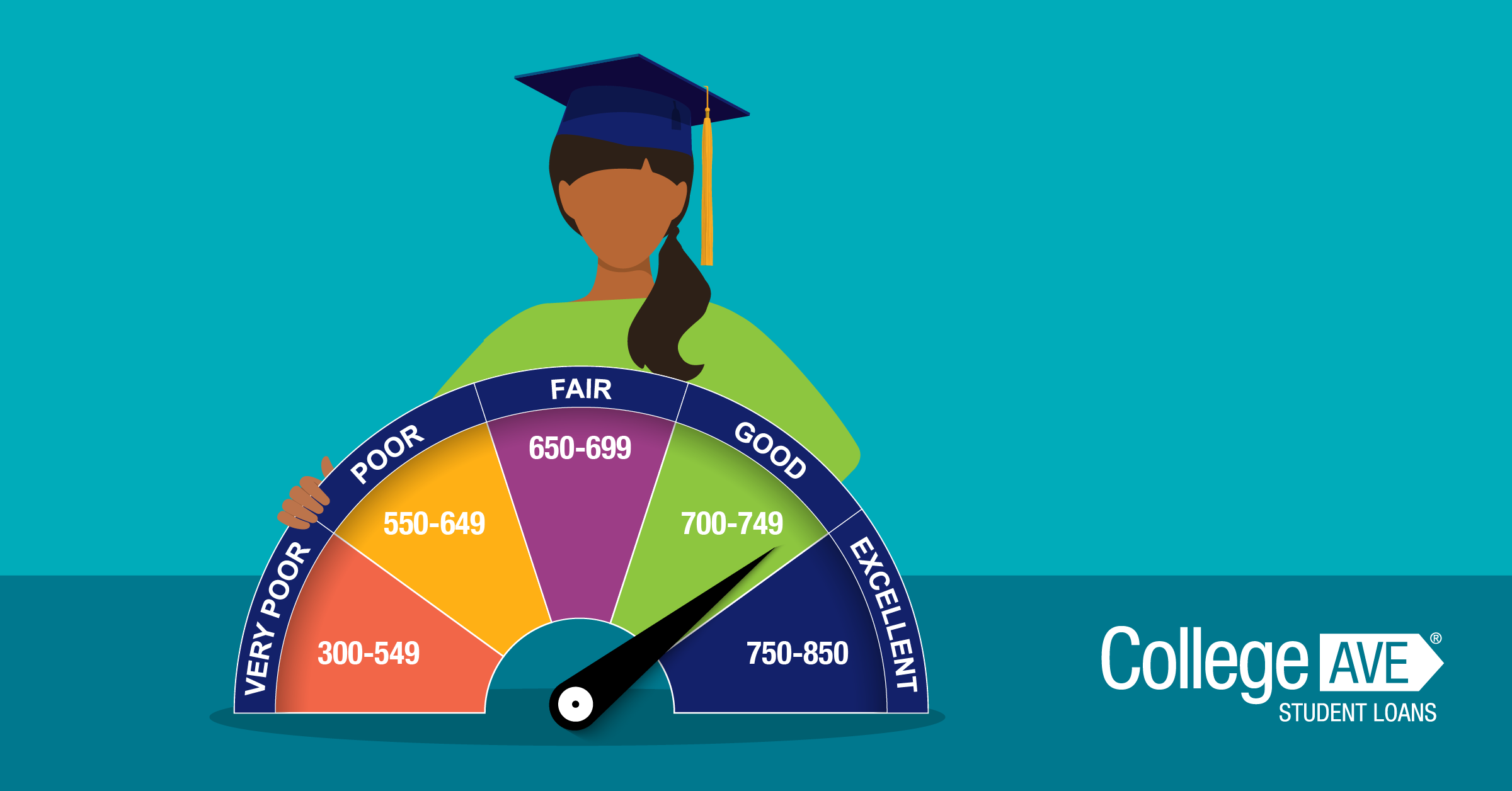

VantageScore is a combination of several factors, such as your payment history and credit limit. Your credit score is also a factor. Your score can be affected by your credit history. For instance, if there have been many late payments, it will be lower than if there were only minimal payments. Using a credit score calculator is a good way to improve your credit score.

It is different from FICO scores

There are important differences in FICO scores and Credit Karma score. While the FICO scoring model is more widely used by financial institutions, Credit Karma uses a different model, VantageScore(r). These scores are still similar to FICO scores, but they look at different factors, including length of credit history, new credit and the mix of credit types.

It's a gentle check

Credit Karma, a free service that shows you your credit score and can help you improve it, is available for no cost. It breaks down credit scores into different categories and shows you areas that need to be improved. It can also help you identify identity theft and correct errors on your credit reports. Regular credit scores checks are important.

It's free

Credit Karma is a free service that lets you access your credit score and report without hurting your score. Credit Karma counts each soft inquiry as a credit inquiry and does not affect your score. Contrary to a soft inquiry, which is not recorded on your credit report, and can result in a drop of 5 points per inquiry, whereas a hard inquiry can lower your score by 5 percent. Hard inquiries are also kept on your credit report for two years. Credit Karma gives you the opportunity to view your credit report completely free. However, Credit Karma makes money by encouraging customers to sign up with advertising-based products.

It is true

Credit Karma allows you to break down your credit score into various factors such as credit utilization and payment histories. It is possible to identify the factors that are affecting your credit score and make changes to improve it. To build credit, it is important to make timely payments. Missing two payments, for example, can have a big impact on your credit.

It is wrong

Credit Karma has a way that you can avoid the most common mistakes. While credit scoring models are different from company-to-company, they all use the same basic factors to determine creditworthiness. These factors include how long you've been paying your bills and what types of credit you have. Credit Karma's model is based on the VantageScore(r) 3.0 model, which uses the same basic factors as FICO to calculate a score.

How to dispute inaccurate information on a credit report

You should promptly dispute incorrect information found on your credit report. To do this, you can write to the companies that reported the information and request a correction. Make sure that your dispute letter accurately and clearly states the facts. For proof of your case, you might include a copy to your credit report and other documents. Make sure you send your dispute letters via certified mail with an acknowledgment.