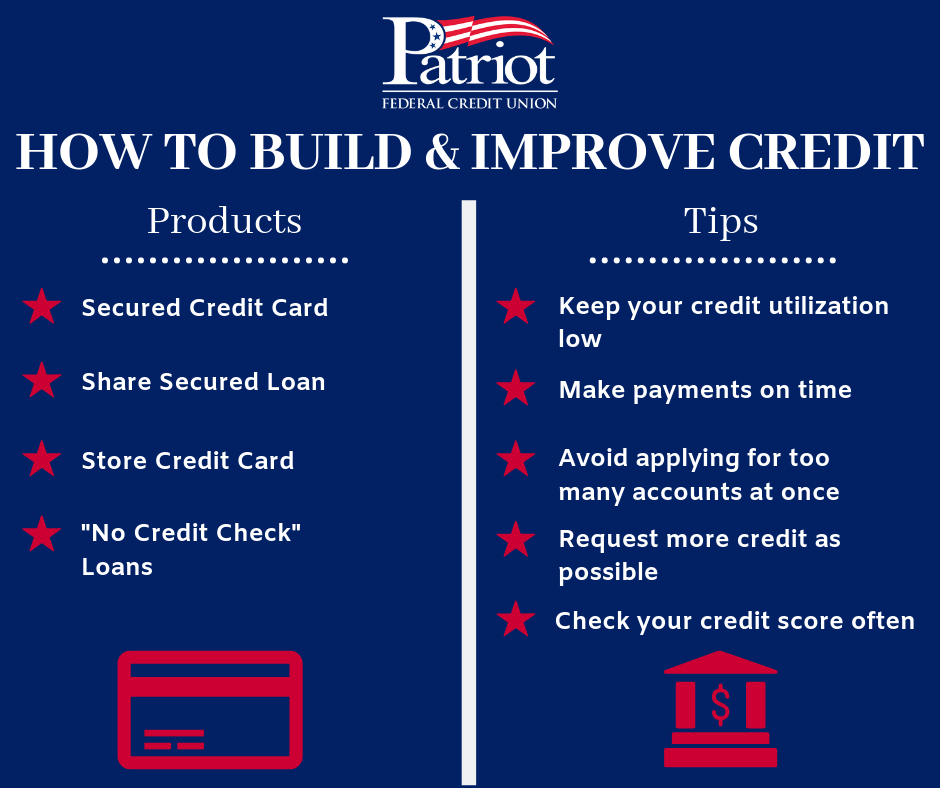

Your chances of getting a home equity loan can be increased by diversifying your credit portfolio. Diversifying your credit accounts can help to maintain a low rate of credit utilization. A variety of accounts can help raise your credit score. It will also improve your payment history. Here are some tips to diversify credit. Once you have a good credit mix, you can start applying for a home equity line of credit.

It can increase your chance of getting approved to borrow money

Your overall credit strategy should include mixing your credit history. Lenders want to see a broad range of credit accounts. Having a mix of both new and old accounts helps your FICO score. However, don't get carried away with opening new accounts for the sake of boosting your score. It's better not to open new accounts for every type of credit, and to keep your credit score balanced.

You should have both revolving as well as installment credit. It is simple to manage your revolving credit and you should make sure that you pay all of your bills on the due date. It is important to not accumulate too much debt. You should only charge what you can pay each month. You can get a personal loan if you don't have enough installment credit. This will demonstrate to lenders that you are capable of handling different types credit.

It can help you keep your credit utilization ratio low

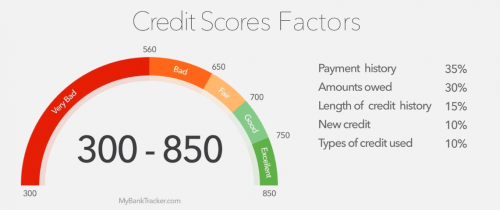

The credit utilization ratio (or credit utilization) is the ratio of your total credit card credit to the amount you are using. It is usually expressed as a percentage such as 25 percent. For example, if you have $10,000 available on two cards, but you are only using $500 of it, your credit utilization ratio is 50 percent.

If your credit utilization ratio is high, your credit score will suffer. There are several ways to lower your credit utilization ratio. You can start by limiting the amount of outstanding balances on your credit cards. The first thing you can do is to not carry a balance exceeding 50% of your credit limit. This is especially important if you have multiple lines of credit.

Avoid making large credit card purchases. Credit card purchases of large amounts can increase your credit utilization ratio. You should pay these debts off as soon possible so that they do not become due. This will avoid you reporting a high credit utilization ratio to the credit bureaus. This is especially important for those who need to apply to loans in the near future.