A bad credit credit card is one that has high interest rates. This type of card should not be used. It can harm your credit. There are many better options available, such as cards that offer 0% introductory APR for purchases and balance transfer. Before applying for one, be sure to carefully read the terms.

Credit cards with better credit ratings may offer 0% introductory interest promotions for purchases and/or balance transfers

A credit card offering with a 0% APR is a great opportunity to lower your monthly expenses. If the introductory interest rate isn't met, however, you may be responsible for the interest. You could also make automatic monthly payments to help you pay off your balance fast. Although this might seem like a complicated process, it can help you achieve debt freedom sooner.

Take the time to review the terms and conditions in order to get the best balance transfer promotion at 0% introductory interest rate. These terms should outline how you can balance transfer, what the payment period is, and what happens if your balance balance remains unpaid after the introductory APR period ends. For any questions, you can contact the card issuer.

Signs of a Bad Credit Card

Signs of a bad credit card include high interest rates, penalties, and an escalating debt. You may also experience a decrease in your credit score and little reward. This is regardless of your purpose, whether you want to improve your credit rating or build credit.

A bad credit card can cost you money

It is important to know the various costs involved in obtaining a bad credit credit card. These cards do not offer any sign-up bonuses or rewards. You will also need to make a deposit of $200-$5,000. This money is what will limit your credit score when you open an Account. These cards may not offer you the rewards that you are looking for but they will allow you to build credit.

The fees and APR should be considered when evaluating credit cards. Also, check out the annual fee and monthly maintenance fee. These are two unnecessary expenses you may not be required to pay. So that you don’t end-up paying large interest, it is important to choose a card with low rates of interest.

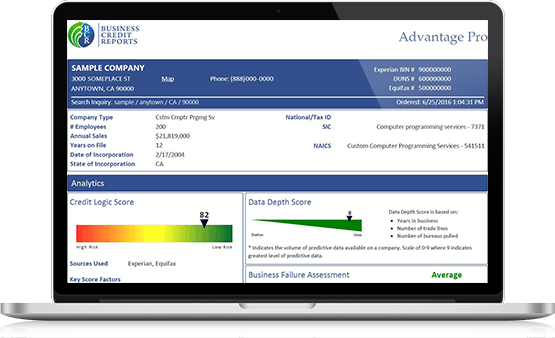

Approval for a card with bad credit

A new credit card is one of the best ways you can rebuild your credit. You should be aware of a few things before you apply for a credit card. Also, consider your ability and willingness to pay any fees or security deposit. It is also important to consider any rewards provided by the card.

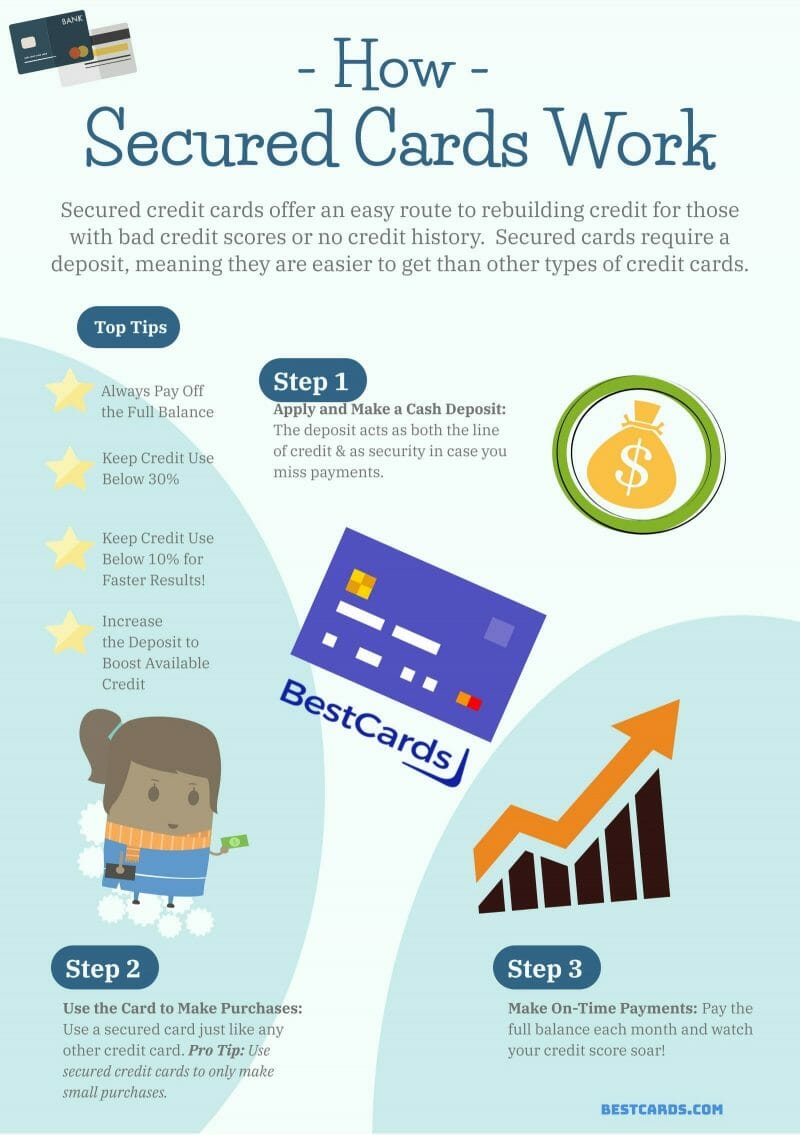

Apply for a secured credit line card. Secured cards require a deposit which is returned to the issuer in the event that you fail to pay the balance. This option is great for people who have bad credit, as it allows them time to pay down their balances. However, you should keep in mind that getting approved for a secured card is not a sure thing. Bankruptcy or other serious credit problems can make it impossible to get this type credit card.

Avoiding fees on a bad credit card

There are many ways to avoid fees with a bad credit score card. One of the best ways is to avoid making cash advances or balance transfers. These can lead to exorbitant charges. Additional fees could be applied if you are purchasing in another currency.

If you find yourself in this situation, you should contact your credit card issuer and ask if you can avoid paying fees. You can often get these fees waived by credit card issuers if your research is complete. There may be an option to negotiate a lower interest rate.