You can build good credit with a credit card if you can pay off debt on time. Paying your bills on time and setting autopay are great ways to build credit. But the most important tip for building good credit with a credit card is to make sure that you keep your accounts open. Here are some guidelines:

Credit card: Building credit

Using your credit card every month and making all your payments on time is the most effective way to improve your credit. To improve your credit score, try to keep your credit limit at 30 percent of your available credit. Set up autopay so that your purchases are automatically paid the minimum amount. This will allow you to spend more freely. You should also try to stay within your credit limit so that you don't overextend yourself and pay more than you should.

You should consider a secured credit credit card if your credit score is just starting to improve. You will need to make a deposit of at least $200 to get a secured card. Once you have the card, you will be given a credit limit, which is usually the same as your deposit. Some secured cards require higher deposits, while others do not. This will allow you to make a decision about whether you want a higher credit limit or lower deposit amount.

Paying off debt with a creditcard

You may feel overwhelmed if you have too many credit card accounts. Smart money decisions can help you reduce your debt. This article will explore several approaches to debt management. Continue reading to learn how to responsibly use credit cards and improve your credit scores. To determine the best strategy for you, consult a financial adviser. Here are some ideas:

It is important that you read and understand all terms and conditions prior to using credit cards for debt repayment. These terms and conditions are provided by credit card issuers when you get your card. These terms and conditions will assist you in managing your spending habits and making timely payments. Although it can seem difficult to clean up your credit, it is possible. Remember that credit cards are an excellent financial tool, but if you're not careful, you may end up with too much debt.

Set up autopay to build credit using a credit card

While autopay allows you to set a monthly payment amount, you should always make sure that you can cover the amount due. You can usually set autopay to pay a specific amount. However, it is important that you keep track of your account balance as overdraft fees and return payments could occur if you fail to pay. Autopay is a great option. First of all, it can save you time and money.

Autopay can also improve your credit score because it makes monthly bill payments automatic. You can set up autopay via your company's bill system or directly from your bank account. Autopay makes it easy to pay your bills on time each month. This helps maintain good credit scores. Autopay allows you to choose a lower interest rate than what you were paying before.

To build credit, keep accounts open

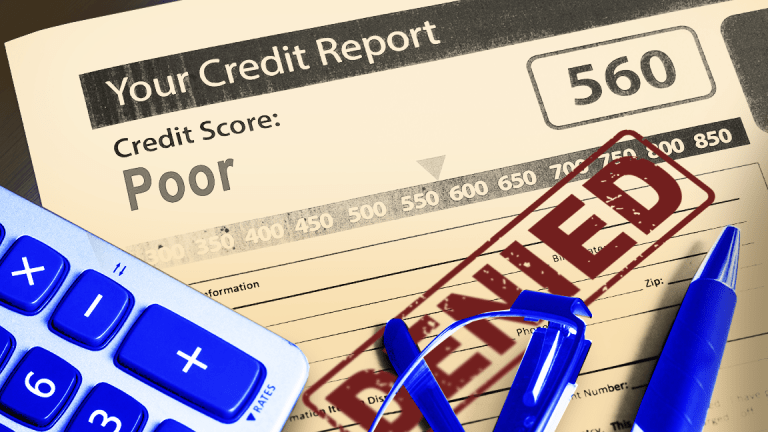

Creditors will see you as more reliable if you have a longer credit history. It is vital to keep your creditcard accounts active. Your credit score will be affected if you close your accounts. Credit Strong can help you build your credit history. These types of accounts can build 120-months of credit history and are completely free to cancel. You should not open new credit cards if they aren't necessary.

It's crucial to make all your payments on time. You will see a decrease in your credit score if you make late payments. Your credit score can be affected if financial institutions report late payments to credit bureaus. Your credit card should not be viewed as a debit credit card, if you're trying to improve your credit rating. Instead, pay the entire amount each monthly to avoid getting into debt.