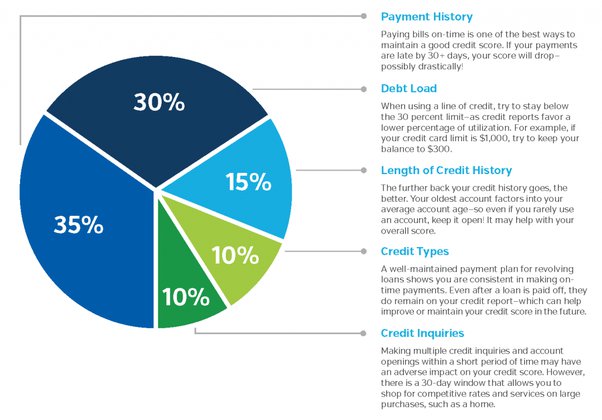

Your credit score depends on many factors, such as your credit history, type of credit you have used and your payment history. The length of credit history makes up three-quarters and your amounts owed the other 30%. The types of credit you have and their use are each worth ten percent of your score. These factors may have different weights for different borrowers.

Timely payment

Paying on time will improve your credit score. You can set up automatic payments to pay off your credit card bills on time, so you never have to worry about missing a payment. You can also set up reminders by email or text to remind you to pay your bills on time. This will prevent you from paying late fees or increasing your interest rate.

Your payment history makes up 35% of your credit score. This tells lenders how often you pay your bills on time and how many days you are late. This shows the amount of missed payments. You will lose your credit score if you delay paying your bill for more than 30 consecutive days. However, there are ways to repair your credit score if you're experiencing financial difficulty.

Making payments on time is the best way to build a solid payment history. While late payments cannot be refunded, they can be reduced over time. FICO scores will go up if payments are made promptly. Additionally, if you are late on a payment more than once, it is possible to contest it. To do this, you should contact the lender directly. You may need to provide proof that the payment was made on time.

Current student loan payments

Making on-time student loan payments can have a positive impact on your credit scores. Higher credit scores mean that you are less likely than others to default on loans. You can lose your score if you make late payments.

Federal student loan payments are on pause until the end of 2022, which is beneficial for your credit. If you pay your bills on time, your credit score will increase. It is possible to have your credit rating tarnished for years if one of your payments is missed. It is important to keep your credit safe by paying your bills on time.

Student loans may not be as detrimental to your credit score than revolving credits, but they can still lower it. Even if your payments have been on time for years you could lose your credit score if you make a single mistake. Student loans are generally installment loans so lenders report late payments. Paying your student loan on time will give you a good credit record and help improve your credit rating.

Other factors that impact credit score

A variety of factors affect your credit score. One of the most important is how many accounts you have. An excessive number of accounts can lead to a lower credit score. Additionally, you may be at greater risk for default. Low credit utilization rates can improve your credit score. It is also important to consider the number of creditors you have. Your credit utilization rate is the percentage of your available credit that you are actually using.

Your credit history, along with the type of credit you have, can impact your score. It is good to have a long record of paying on time. If you are late paying, your credit score will suffer. The amount owed can affect the effect of a late payment, which may be lower than a 30-day missed payment.