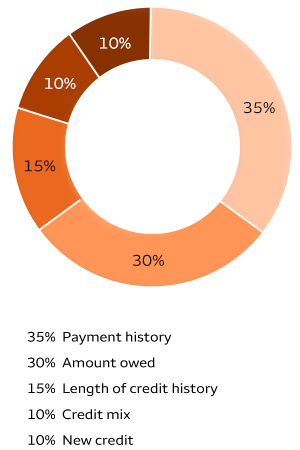

Credit score is calculated by a combination of several factors, such as credit utilization ratio, interest rate, length of credit history, type of accounts and length of credit history. These factors contribute about 30% to your total score. Your score could be affected if your credit utilization ratio exceeds 30%. There are however ways to lower this ratio.

Credit utilization ratio accounts for 30% of credit calculation

Your credit utilization is an important aspect of your credit score. This can make the difference in whether you get approved for loans or not. There are many ways to increase your credit utilization ratio. This includes paying off your monthly balances. First, find out how much credit you have available. LendingTree's credit score tool can help you to do this. It's totally free and will display your credit score along with what you owe.

The best thing to do is to use less than 30% of your available credit, but the exact amount depends on your situation. If you use less than 30% of your available credit, your score will be higher. Schulz suggests that you keep your credit card balances at 30% of the maximum. A minimum credit card balance of $300 per calendar month will help you improve your score.

Credit score calculation takes into account different types of credit accounts

Credit score calculations include a range of factors such as your credit history and the number of credit cards you have. Your payment history and the number of revolving credit accounts you have can affect your credit score. Some credit scores are affected more by this than others. Revolving account openings are more straightforward than those for installment loans. It is therefore important to ensure that you only open the accounts you need. Examples of installment loans include auto loans, mortgages, and student loans.

Possessing multiple credit accounts can help improve your credit score. This shows lenders that you're able to manage different types of debt. It is possible to be considered risky if you open many new credit accounts. Your credit score will rise the more diverse your credit history is.

Credit Scores affected by high credit utilization

Credit utilization ratios that are high can adversely impact your credit score. You can avoid a drop on your credit score by making large purchases as quickly and efficiently as possible. So that high credit utilization does not get reported to credit bureaus it should be paid off before the due date. This is especially important if your next credit card application is imminent or you want to maintain your highest score.

Another way to decrease your credit utilization is to get a personal loan to cover large purchases. These loans are basically installment loans that have fixed interest rates and a predetermined payment schedule. Personal loans, unlike credit cards can be used however you wish.