A low credit score does not mean you cannot apply for a mortgage, checking account or rewards credit card. Wells Fargo checks your credit history as well as how you pay bills. They also look out for accounts that have not been paid or were charged off within the past two years.

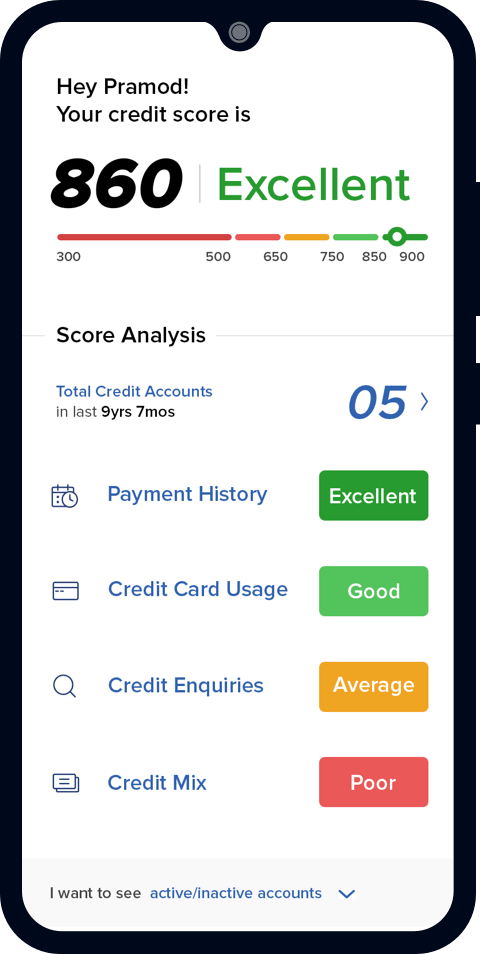

Acceptance of credit scores as low 600

Wells Fargo can approve you even if your credit isn't perfect. Wells Fargo can provide credit to individuals with low credit scores and other credit types, unlike online lenders. It has requirements that are lower then those of most online lenders. They also accept credit scores down to 600.

Is a mortgage lender reputable?

One of the largest banks in America is Wells Fargo. Their mortgage rates vary widely and depend on several factors, including the size of the down payment, the length of the loan, and the borrower's credit rating. Check out their website for more information on Wells Fargo mortgage rate.

What makes a good check account?

It's possible to have a good credit score while still having a Wells Fargo check account. However, if you have a low score, you may have a hard time obtaining a loan and landing a job. Your ability afford college tuition and other expenses could also be affected if you have a low credit score. These are some ways to improve your credit score.

What is a rewards credit card?

Wells Fargo credit Cards can be a great place to begin building credit. This card is not for everyone. However, you need to have a high credit score in order to be approved. You can get up to 22% cash back on large purchases if this card is approved. You can use this card to pay off your debt.

Is a debit card

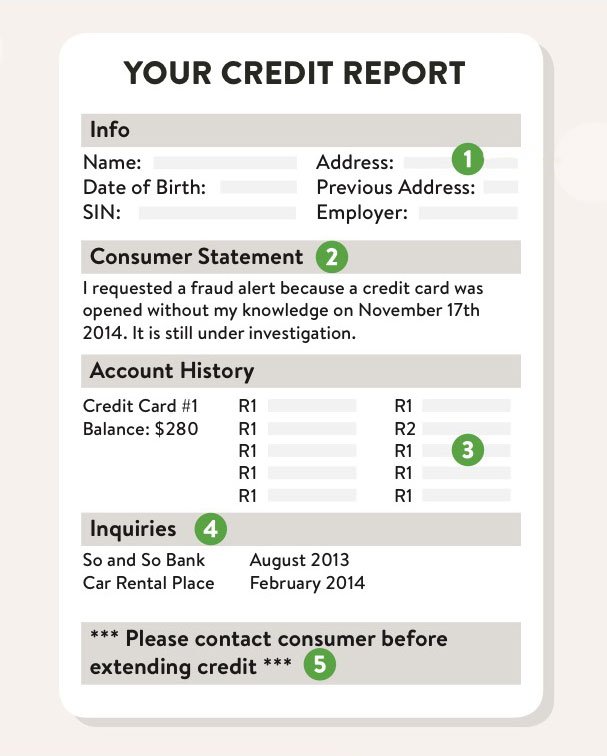

When evaluating whether you qualify for a Wells Fargo credit card, your credit score is an important factor. The company will evaluate your payment history and how much you owe. Wells Fargo is especially wary of people with charged-off accounts.

Is Wells Fargo offering a checking or savings account?

Wells Fargo offers a number of different types and types of checking accounts. Premier Checking is the first, and requires a $25 minimum initial deposit. The Premier Checking account charges $25 per month, but there are no ATM fees. It also offers lower auto loan interest rates and waives ATM fees. The account comes with extra benefits, including the ability use ATMs in other locations than the bank's.