If you are new to finance, it can seem intimidating to learn how to build credit. A credit account can make it seem like you're in a tight spot. Lenders are likely to turn you down because of your lack of credit. Good news is that you can begin building credit as early as 18 years old! These tips will help you get the best interest rates.

It is important to pay bills on time

It is possible to improve your credit score by paying all of your bills on time. Be sure to list the lender, minimum monthly payments, and the balance owing. This list can be divided into categories according the method you use to pay. If possible, modify the due date or use an electronic payment system. You can even specify an amount to debit automatically.

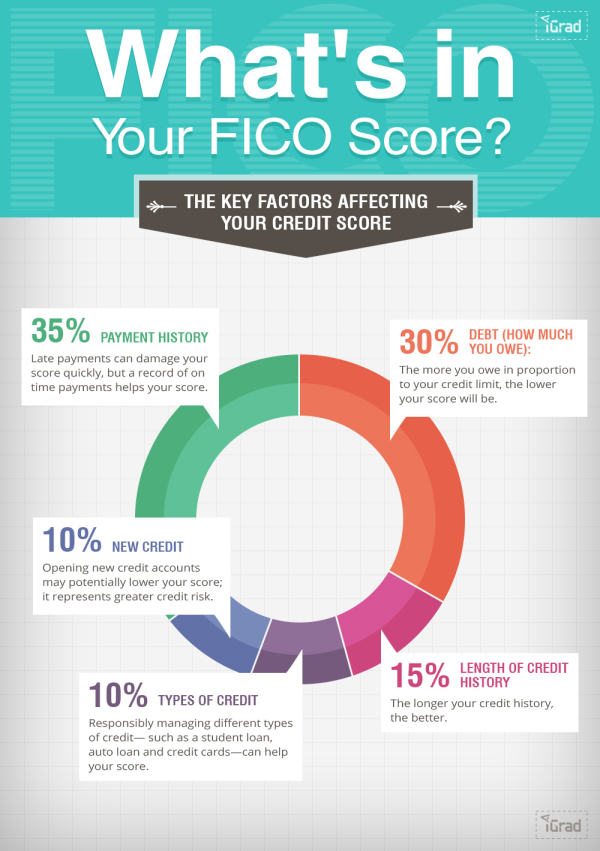

Credit score is influenced by your payment history. This accounts for over thirty percent of your credit score. Make sure you pay on time. You could be charged a late fee and even have your credit report removed. Credit reports will likely include information about your credit cards, loans, and sometimes utility and mobile phone accounts. Your credit score can be built by paying your bills on-time.

Multiple credit cards

It may seem like a good idea to have several credit cards. However, this can lead to financial trouble. Although multiple credit cards may seem like a great way to save money, they can lead you into significant debt and financial trouble. You should avoid using multiple cards for rewards. Instead, stick with one. You will get the best results if you only have one card. You should then pay it off as soon you can. This will help you keep track of your payments and avoid overspending.

Although having several credit cards can increase your credit score it can also be detrimental. It's better to limit the number of credit cards you have and to make minimal monthly payments. Multiple credit cards can increase your credit utilization. Make sure you only use the ones that are right for you. It's best to have two or three credit cards that are appropriate for your credit profile. Your credit score will improve if you keep track of your payments.

You can increase your credit limit

You should request an increase to your credit limit when you have just graduated college or received an extra income. It will be easier to make small purchases and increase your spending power. Requesting an increase is much simpler than applying for a new card. You may request an additional pay increase if your salary has increased or you have just moved to a higher paying job.

Once you have established good payment records with your cards, you should call your credit card issuer and ask for an increase. While you are waiting, explain why you need a greater credit limit. You can tell your credit card provider about your recent salary rise or excellent payment history if you have received one. High credit limits make you more attractive to creditors. But, increasing your credit limit for building credit doesn't mean that you can get a credit card with no interest or fees.

Credit builder loans

A credit builder mortgage is a great way of improving your credit score and building credit. These loans are deposited into your account and require monthly repayments towards the final payment. Your credit score will rise if you make timely payments to the three major credit agencies. Late payments can lower your credit score. However, you should make sure that the monthly payments are affordable. Credit builder loans are generally available through your bank, credit union or online lender.

Although credit builders loans don't require formal credit checks, some lenders use your banking history (provided to ChexSystems) in determining your eligibility. A bounced check could also affect your loan approval. You must be a member of a credit union to get these loans. A membership fee of just a few dollars is required, as well as a donation to the partner charity.