If you're a first-time credit card user, your goal is to avoid overspending, but you'll also want to make sure that you can pay off your purchases. Before applying for a card you must decide which purchases should go on that card. These purchases can be made in cash, or borrowed money. If you use a credit card responsibly, it will help you build a strong credit history in the future.

It is easier to get secured credit cards

Secured credit cards are the easiest type of credit card to get. These cards require a cash deposit of at least $500 to secure a line. Although these cards do not require credit scores, you should plan your spending and pay your bills on time. Secured cards are more flexible than unsecured credit cards. You can cancel or upgrade them if you don’t use the money right away.

A secured card is easier to get than a regular credit card. It will also build your credit history. Secured credit cards often offer cash back and rewards, which allows cardholders to take advantage of their purchases and build credit. The credit card company may also be able to use a security deposit in the event of your default on payments. This deposit is refundable if you make your payments on time.

They offer rewards

Many of these beginner credit card offer rewards on every purchase. These cards do not have an annual cost, which is a plus. This means you can earn cash back on every purchase. These cards also provide a pathway to an unsecured card. Here are some things you should know.

Starter credit cards are designed for people without a great credit history. Some cards offer introductory APR periods of 0% for twelve- to fifteen months. While spending above the limit does not earn you rewards, others offer 0% APR periods that last for twelve to 15 months. Avoid interest charges by paying off your balance within the introductory period. There are many cards that offer lower interest rates than the introductory period. This can help you save significant money. Be careful to not overspend to receive the rewards. You shouldn't spend more than what you can afford. The rewards won't be worthwhile and you will end with a balance. This will take away your savings as well as increase your debt.

They have a low interest rates

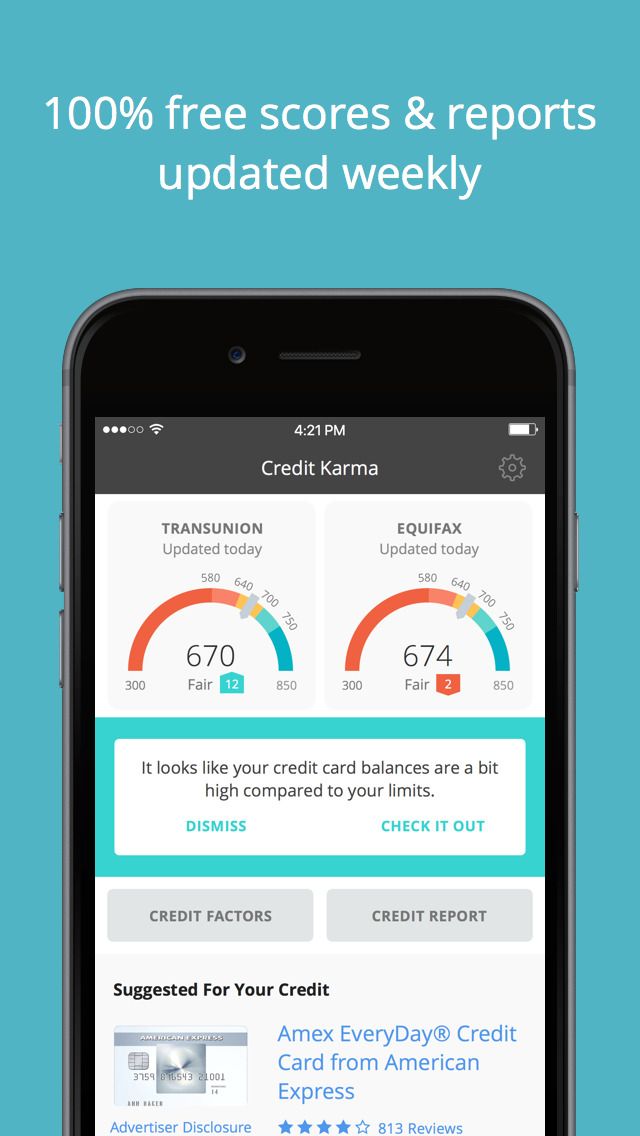

For people with little credit history, beginner credit cards are ideal. They can help you build your credit and learn how to handle credit responsibly. You'll pay less interest over the long-term because these cards have lower interest rates and promotional periods. These cards also offer perks such rewards programs.

The best beginner credit card is not easy to choose. Compare offers from different credit cards companies, such your bank or credit Union. Make sure to consider different perks, variable APRs, and requirements. Be on the lookout for high-end, variable APRs. Pre-qualification is also a good idea, as it doesn't affect your credit score.

They offer trip interruption/cancellation/delay protection

This insurance covers you for rebooking your flights and hotels in the event of an emergency. The coverage pays for non-refundable ticket costs and reimburses you for change fees. Reimbursement is also available if your flight is delayed more than 6 hours. You and your family members can also claim this benefit. The coverage is not available for round trip travel. You can only use it once per calendar year.

This type of coverage is offered by several credit cards. You can choose according to your travel needs the credit card that is most suitable for you. Some credit cards offer higher coverage than others.

They offer a waiver from collision damage on auto rental vehicles

Many credit cards include auto rental collision insurance waiver protection. This coverage will reimburse you if your rental car is stolen or damaged in a collision. Most vehicles are covered up to their actual cash value. The benefit is not as extensive as full liability coverage. Some credit cards also cover towing charges and lost use fees if they are issued by a rental company.

Capital One Venture Rewards Credit Card offers insurance that covers auto rental collision damage waiver. This coverage will reimburse you for any damage you suffer while renting a car. It is limited to the car's actual cash value. The rental car must be less than $75,000 in manufacturer's suggested retail prices to qualify. Also, rentals are limited to 15 or 31 days per month in the country where you reside. You can also stack rental car perks with Hertz.