The FICO Automotive Score is a credit score used to evaluate potential borrowers by car loan lenders. It comprises a base FICO Score and an industry-specific overlay score card. The industry-specific overlay score cards are designed to assess auto debt risk.

Variables in the FICO auto score

Lenders use the FICO score to determine whether you are a suitable candidate for an auto loan. While it can be modified in many ways, it is the most popular score used by lenders. The most recent version of the FICO auto score is FICO 9 and was introduced in 2014. It is available from all three major credit bureaus. For better credit scores and better deals, you need to be familiar with the weights assigned each variable.

Credit bureaus can report information to them from different sources. These include debt collectors, loan companies, and others. Be aware that not every company reports to all three bureaus. Your FICO score can be a composite of all your credit reports. It may not be accurate.

Variables in your VantageScore credit score

Your credit score is determined by a number of factors including your payment history, credit account age, and your credit card debt. These variables contribute 61% to your total score. FICO allocates 35% of the weight for payment history, 10% for new credit lines, and 15% for overall credit history. Late payments are equally punished by both credit scores. Your score can be raised by responsibly using credit and making timely payments.

VantageScore 4.0 is the latest VantageScore credit model. It uses longer histories to give a more comprehensive picture of a borrower’s past credit history. TransUnion and Experian both have more strict reporting requirements in regards to tax liens, civil judgments, and tax judgments. Your VantageScore score therefore is more reliable.

How to access FICO auto score

FICO's auto score can help you when shopping for a vehicle. It can also help you keep track of credit history. The FICO auto score, while the base FICO score gives a general idea of your creditworthiness and ability to repay loans, is more specific. It is available in several versions and ranges between 250 and 900. The most recent version, published in June 2016, was based on TransUnion's CreditVision Data trend data and covers up 30 months.

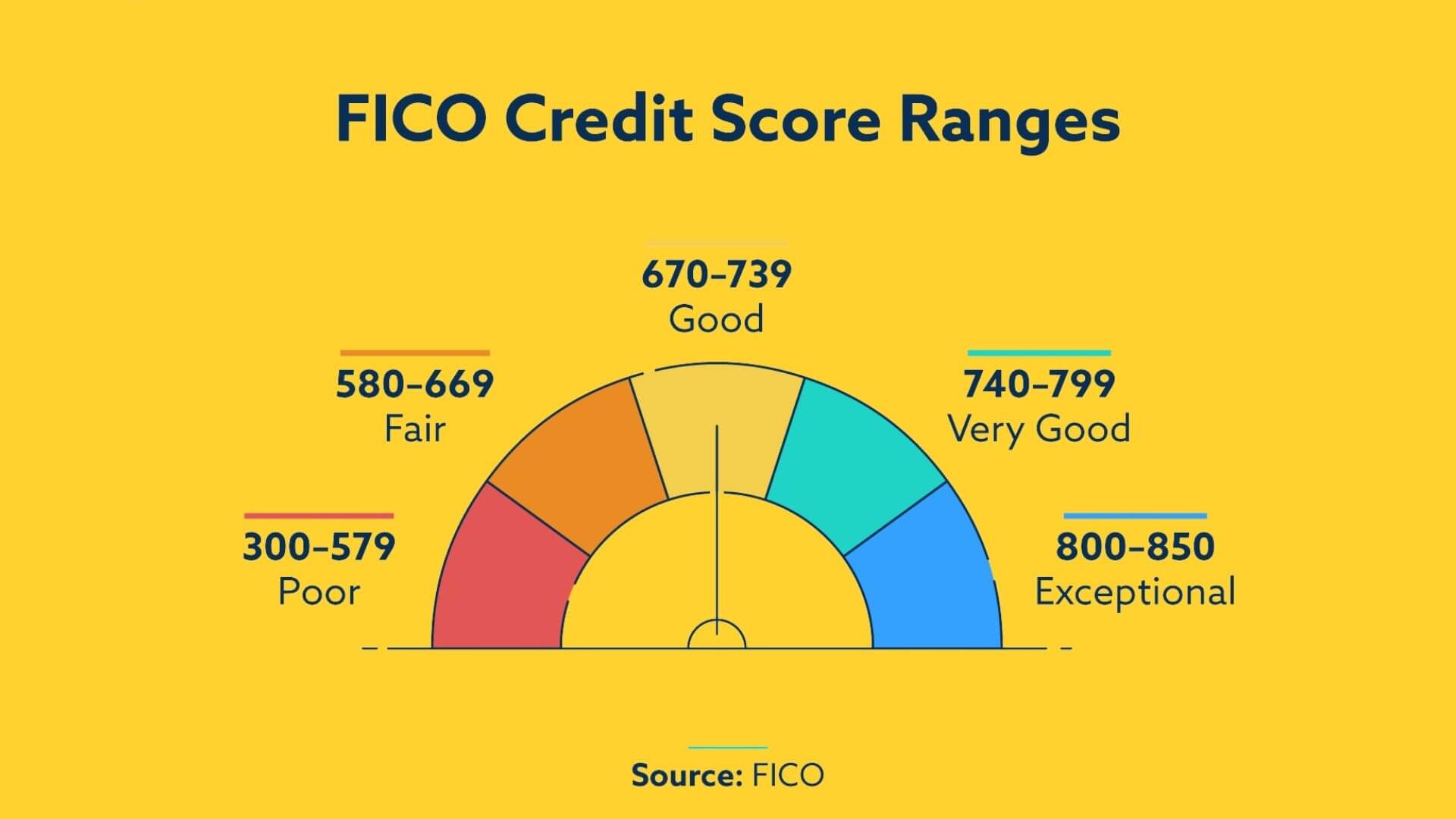

A higher FICO credit score can increase your chances of getting approved for loans and may also result in a better interest rate. A credit monitoring service may allow you to access your FICO Auto Score depending on your financial situation. However, you must note that these services may not always offer the same version as your lender. Many lenders use one of three credit bureaus when calculating their auto scores. Make sure you find out which one you can use.