There are many benefits and drawbacks to choosing the best credit card for young adults. The Capital One Venture Rewards credit cards does not have an introductory APR rate. This is helpful for faster debt repayment. You will not receive a signup bonus which can help improve your credit score. The card cannot be used to withdraw money at ATMs.

Find it Secure

A Discover It Secured credit card can be a great option for young adults to manage their money in many ways. This card is flexible and offers fixed installments over two year. This makes it easy for you to manage your finances. You can also use this card like any other credit card and earn cashback when you purchase. However, the card doesn't offer any extra benefits or rewards like points that you can save for a later date. The cashback you earn when you spend a certain amount will be automatically applied to the next month's account.

It also has low fees, which is another advantage of the Discover it Security credit card. This is an important advantage for those who want to build credit profiles. This card has a regular See Terms APR that is based on prime rate, unlike most secured credit cards that have high fees.

Chase Freedom Unlimited

If you're a young adult with no credit history and are interested in applying for a credit card, you may want to consider the Chase Freedom Unlimited credit card. While this card doesn’t offer any sign-up bonus or rewards, it will allow you to receive electronic statements as well as a free credit score and report. It’s an excellent option for young adults.

Chase Freedom Unlimited is a card that has no annual fees. It earns 1.5% cash back on all transactions. It earns 1.5 percent cash back on all purchases, which is a little less than average. Young adults are still learning how to manage their money and this credit card is a great option. This card can help you reach your financial goals, no matter how often you travel.

Capital One QuicksilverOne cash rewards credit card

If you're a young adult looking for a credit card, you may want to consider a Capital One QuicksilverOne Cash Rewards credit card. The card comes with no annual fees and offers rewards up to 1% cashback on all purchases. Sign-up bonuses can be equivalent to the cash earned during your first year. As an added bonus, you can avoid a foreign transaction fee.

The credit card has a low credit score requirement, which makes it ideal for young adults with good credit scores. To qualify for this card, however, you will need to have excellent credit. You'll also need to keep your score high. However, you can upgrade to the full benefits of the card later on if your credit score improves.

Milestone Mastercard

Milestone Mastercard may be right for you, if you are a young adult searching for a card with credit but have bad credit. It comes with MasterCard perks including extended warranties for large purchases, theft coverage, and $0 criminal liability. You can also get 24-hour international services and airport concierges with this credit card.

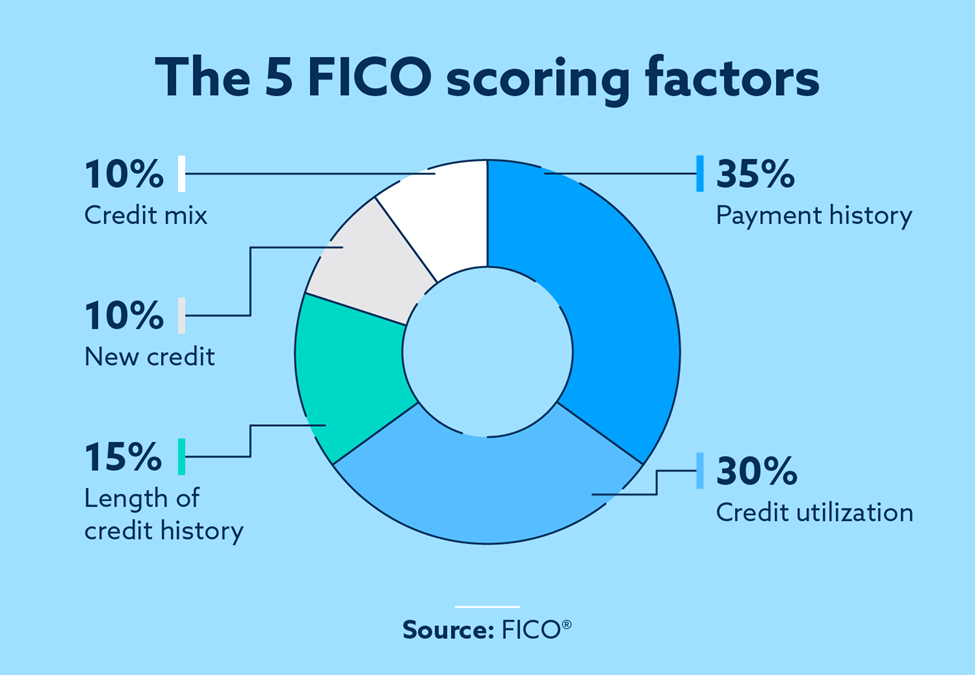

Milestone MasterCards are accepted online, at retail stores and through the app. You must keep your credit utilization low in order to avoid paying high interest rates. It is also important to keep an eye on your account balance and payment history, since you can't control human error or bank processing times.