Your credit score is an important aspect of credit maintenance. Your credit score can be checked free of charge every four months, or once per year. FICO scores reports are available for free from most credit card companies. If you are able, check your credit score at the least three times per annum.

Credit score can be affected by hard inquiries

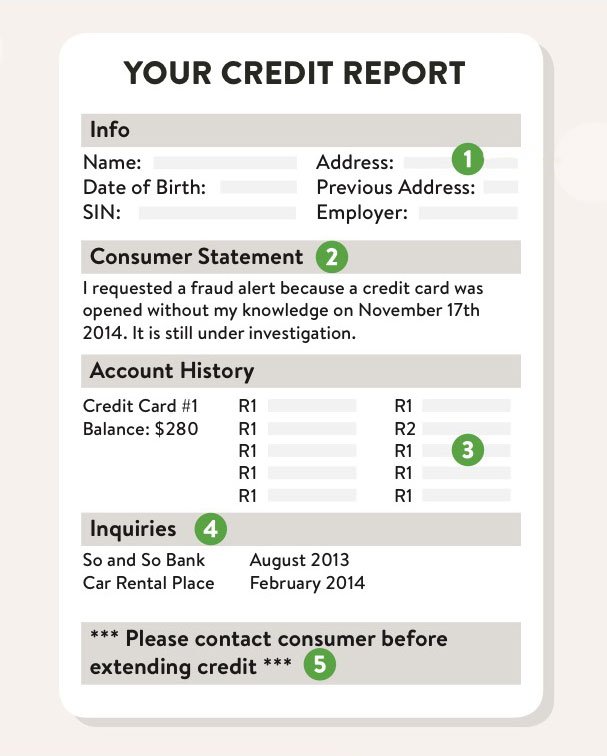

Hard inquiries can have a negative impact on your credit score, even though you might not be aware. When a creditor requests your credit report, it can lead to a negative impact on your credit score. These inquiries often occur due to identity theft or error. Routine monitoring can help you find errors in your credit report. If you discover an error, send a dispute letter to the credit bureau with proof of the error. You can also contact the lender to dispute the inquiry, and report any fraud to the Federal Trade Commission.

A hard inquiry can usually lower your score by one-five points. The exact amount will depend on the credit score you have and how long ago it has been since your previous inquiry. If you are not absolutely required to, it is better to limit the number of inquiries.

It is crucial to pay your bills on time to improve your credit score

When making your payments on time is an important factor in determining your credit score. It is important to make timely payments because late payments can lead to increased interest and make it difficult for you debt to be paid off. Another factor is your credit utilization relative to your total debt. Lenders do not like high credit balances. This is why it is so important to keep credit utilization below 30%. Credit score can be improved by not applying for new credit cards or paying off existing ones.

Your credit score will be 35% based on your payment history. This shows whether you have been punctual with your payments and how often you have missed them. Lenders use this information to determine whether you will be able to pay off your debts in a timely manner. Late payments can harm your credit score. However you'll have a longer payment history which will help your score.

Correct inaccurate credit information

If you feel that your credit report contains incorrect information, contact the credit bureaus to dispute it. They must investigate the error and provide a copy of your credit report. However, the bureau may not agree with your complaint, so the item will remain on your report. You can take steps to correct the error, such as contacting the creditor for clarification, or you can re-dispute it with more information.

Writing a dispute letter is the best method to dispute inaccurate information. It should include a dispute form and copies of your supporting documents. Send your dispute letter to the credit reporting company, using the dispute address on the credit report. It should go via certified mail.

Correct information can cause a drop in your credit score. This can make it difficult to obtain loans or credit card applications. Although the process is not complicated, it can be frustrating if you don't get your desired result. It's worthwhile if you get a complete report.