As a child, credit building can seem difficult. However, it is possible. To build credit, there are some things you can do as a young person. A minimum of one credit line is a great place to start. Co-signing a loan and credit card can also be possible.

Authorized user

Building credit is not just a life skill. But it can help to get the things you want later on in life. Good credit can help get you the best terms on financial services and even save you some money. It requires some planning and research but will pay off in long term.

Co-signing of a loan or creditcard

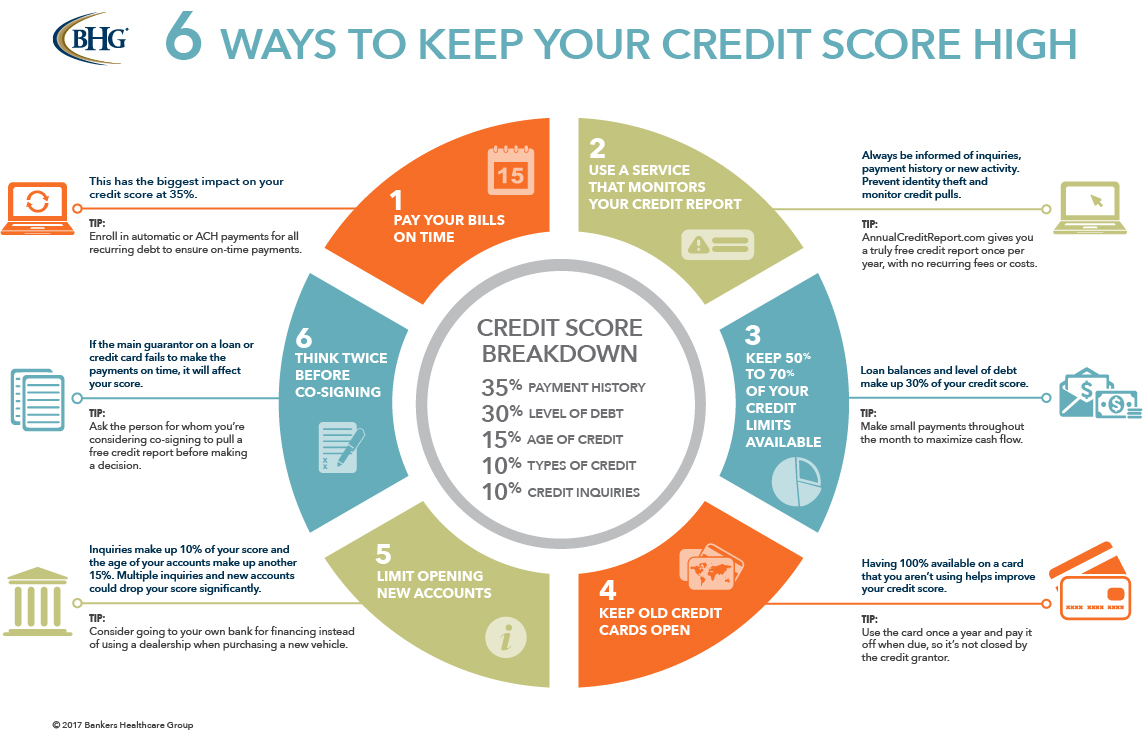

While co-signing for a loan or credit card can increase your credit score and help you qualify for a lower interest rate, you need to be careful. It is crucial to determine if you trust the person signing the loan or credit card agreement and whether they can afford the obligations. Banks are not interested in your good intentions; they simply want to make sure you pay back the debt.

How to get a cell phone plan

If you have good credit history, you may be eligible for a plan that requires low credit. There are many options. These plans are an excellent option for people who don’t wish to commit to long-term contracts. Prepaid plans are also typically much less expensive than traditional plans. You can also add users for very small fees. Numerous major carriers offer incentives for adding new users.

Secured credit cards

Secured credit cards are a great way for you to build your credit history. These cards work in the same manner as regular credit cards except that you must make a deposit. Usually, this amount is equal to your credit limit. You can also have your credit history established by reporting your activity with these cards to the three largest credit bureaus. This will eventually help you get a regular card and other credit products.

Getting a debit card

A debit card can be a great option for anyone who is interested in building credit. Most banks offer a free FICO credit score for new customers once per billing cycle. In that you can withdraw funds from your bank accounts, the debit card is similar to a pre-paid card. If linked to a credit line, the debit card can help you build credit.

Credit cards: Minimum payments

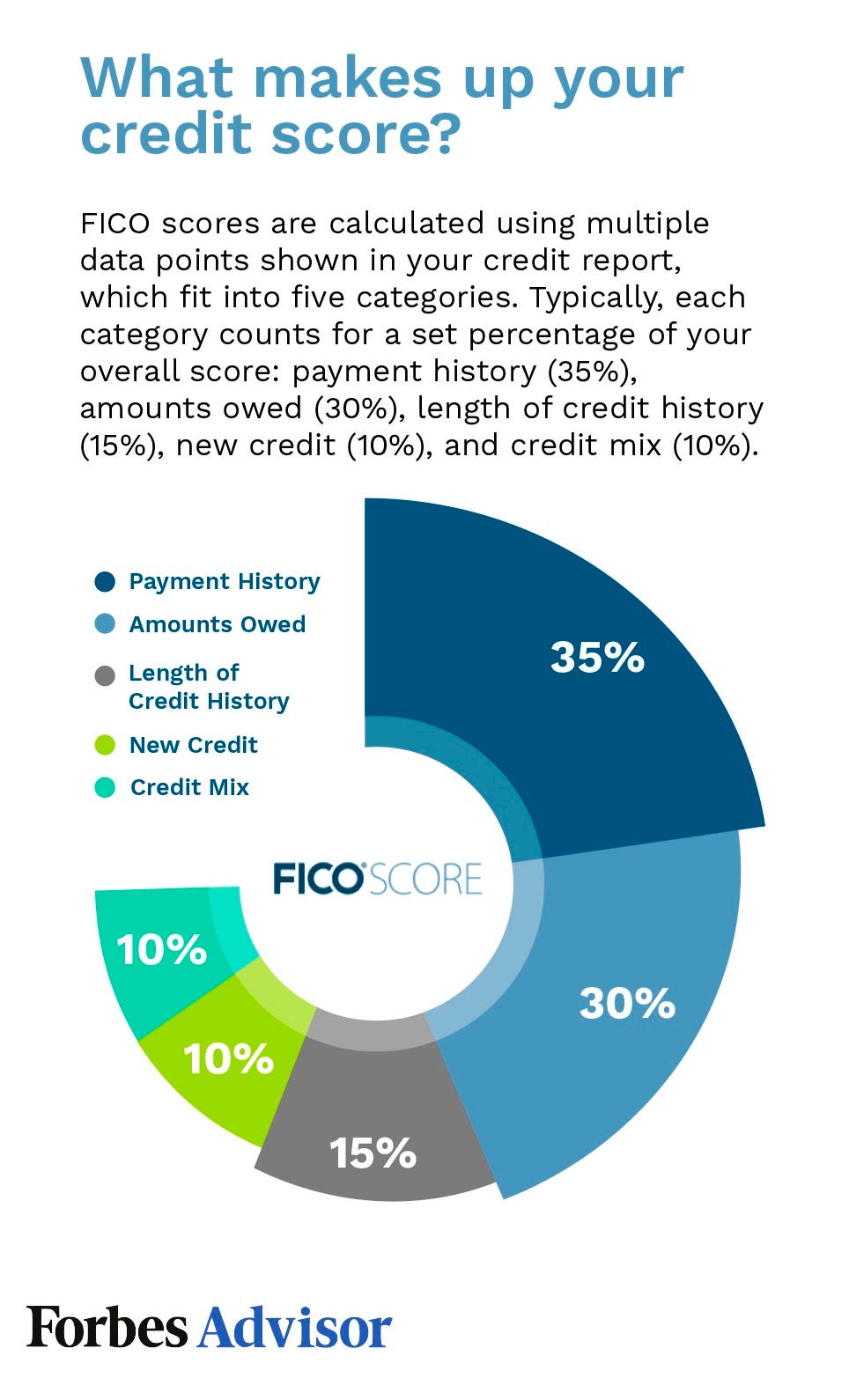

Young adults can improve their credit score by paying minimum monthly payments on credit cards. Unfortunately, young adults don't have a lot of credit history or income, so their options are limited. Young adults should aim at paying off their balances every month and not having more than 30% of available credit.