If you're wondering how to improve your credit score, you should start with paying your bills on time. This is an easy way to increase your credit score in a matter of months. Pay your bills every two weeks, if possible. This will decrease credit utilization, which will improve your score. You can set up a payment schedule if you aren't able to pay on time. It will help you ease the effects of late payments and will improve your credit score. It is best to not open any new accounts as it can damage your score.

Reduce credit utilization ratio

It is important to keep your credit utilization low in order to improve credit scores. Experts recommend keeping your credit utilization ratio below 30%. Even lower is better. A utilization ratio of 1% or less is better than 30%. Different credit scoring formulas might treat utilization differently. The impact of usage varies from one credit file to another. FICO(r's High Score Achievers) average credit utilization is around 4%. The maximum utilization for high-achieving account is 10%.

Reduce your credit utilization ratio to improve credit scores. Avoid large purchases that increase your debt. You can minimize the impact by paying off large purchases before the due date. This is particularly important if you plan on applying for a credit card in the near future. You must act quickly if you want to keep your best score.

Pay off balances

Your credit score can be improved by paying down credit card balances. The rate at which your credit score increases will depend on how much debt you have. Paying off debt can result in a 10 point jump for those who have credit card debt. For those with a smaller amount of debt, there may be a few points more.

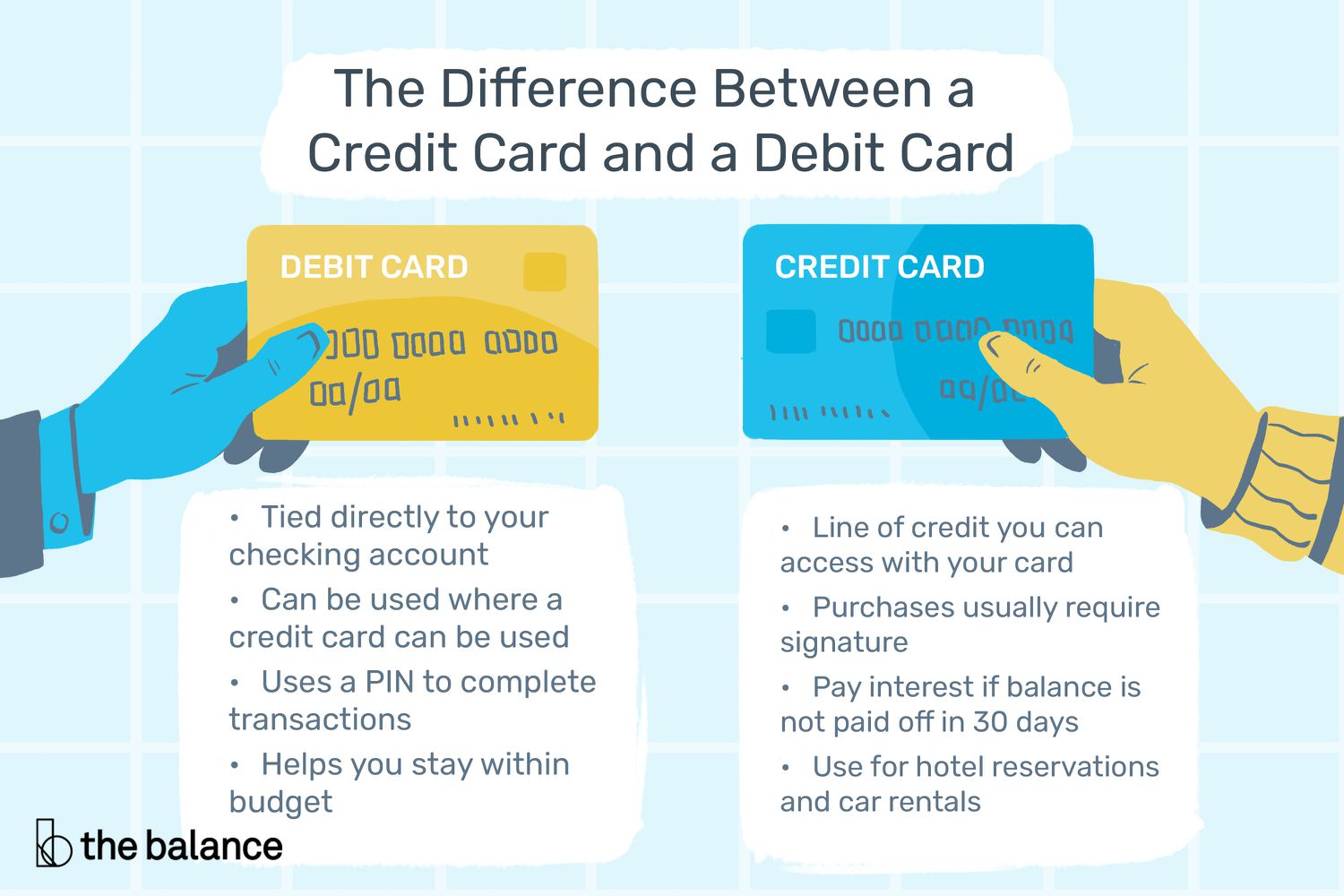

Stop using your card to pay down the balance. It's much more difficult to pay the card off if there is a balance. Instead, think about a strategy for paying down your debt. You could also apply for balance transfer credit cards that offer zero interest over a specific time.

Credit limit increased

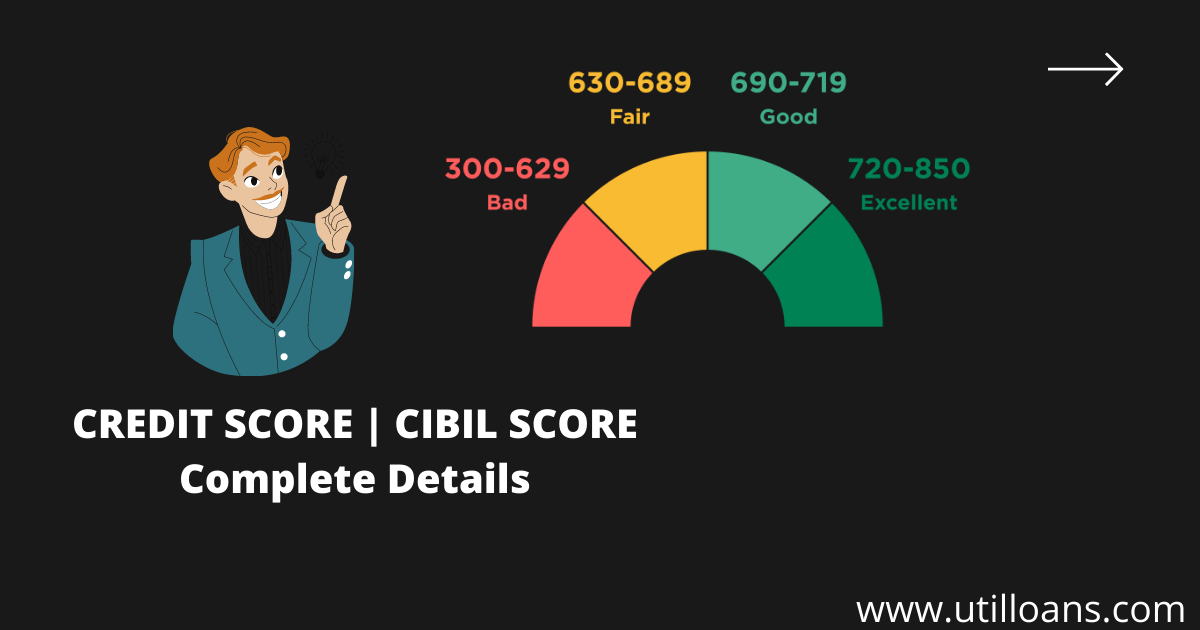

One of the most important ways to improve your credit score is to increase your credit limit. Requesting a higher credit limit from your credit card issuer is one way to do this. Although it may result in a credit inquiry, this will not affect your credit report. A higher credit limit can have long-term advantages that will outweigh any minor inconvenience. To begin with, increasing your credit limit will result in a greater credit utilization ratio. This will help improve your score. Credit scores are based on five factors: payment history, credit limit, amount of debt, credit history and new credit.

Not everyone is able to increase their credit limit. Although increased spending power is appealing, it can cause credit score damage. Increase your limit only if you have the financial ability to pay it off. If you don't have self-control you might be tempted spend more than what you can afford.

Avoid credit repair businesses

You should be cautious when contacting a credit restoration organization. They may claim to be able to improve your credit score in a short time, but it is unlikely that they can. Avoid paying upfront fees to any company. Credit repair companies cannot charge you upfront fees before they perform any work. Check with the Better Business Bureau, consumer protection agencies, to determine if they have received any complaints. If there have been any complaints, this is a clear red flag. Reputable organizations will not charge you upfront for their services. They won't use secretive methods to increase your score or promise results that are too good to be true.

Credit repair firms must offer their clients a written contract that details their services. They should not ask for upfront payments. They must also offer their services within 90 day of receiving payment. The Department of Justice must also register them and require that they file a $100,000 bond. However, only a small number of companies abide by these requirements.