A same-day secured card from Capital One, Chase or Discover is a great option for those who need cash quickly. These credit cards use your own money as collateral. You make a deposit, usually $200 or $500, to open the account and guarantee that you will pay off the balance on time. In return, the lender will grant you credit up to the deposit amount.

Chase offers same-day secured card credit to customers

Chase offers several options to help you secure a card. These options can range from free money to special offers and limited-time promotions. Before signing up for a card you need to review its terms and conditions. Some offers are not available on other cards. Also, be sure to use your card responsibly so that you don't spend more than you have to.

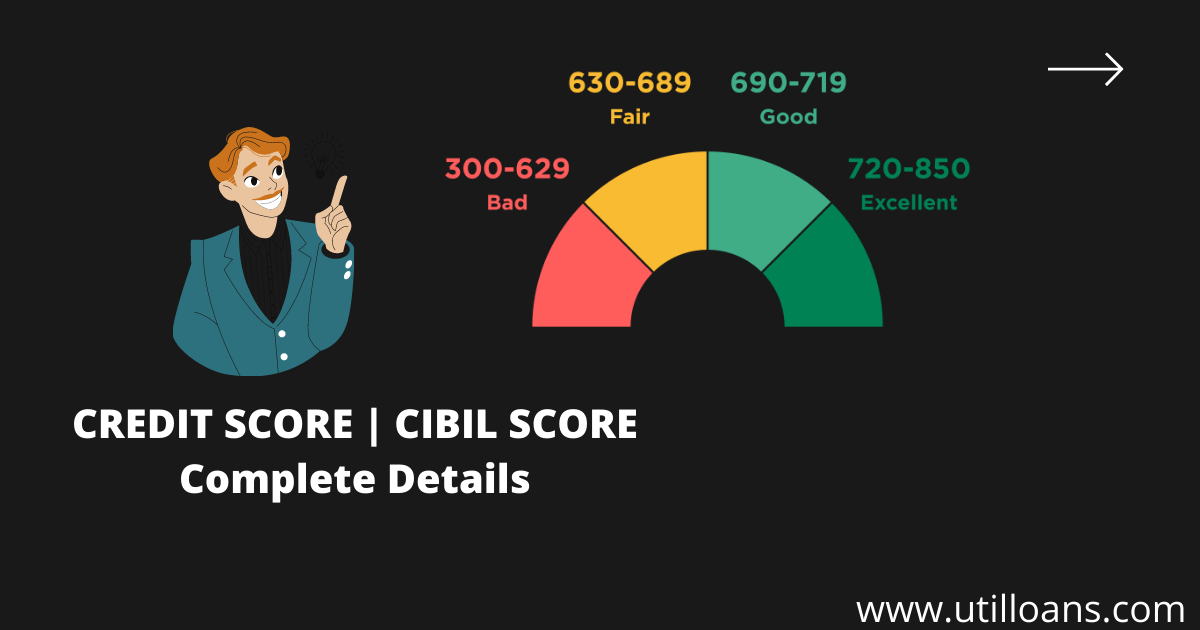

When choosing a secured credit card, make sure you take a look at the terms and conditions. Some credit cards can have an annual fee of up to $49. Other credit cards do not have any annual fees. Consider the length of credit history. A secured card can be a first step in building a strong credit history.

Capital One offers next-day loan

Capital One offers a next day secured credit card for people in financial trouble. These cards can be based on a security deposits, which can range between $49 and $99 or even $200. The amount you pay will be determined by your credit score and financial situation. The credit limit will match the security deposits, thereby increasing your spending limits.

Getting a secured credit card is a great way to start building a positive credit history. Capital One offers several options for secured credit cards, including a Platinum Credit Card. Although this card requires a security fee, it is fully refundable. After six months of responsible usage, you can apply to a larger credit limit. This card is an excellent choice for people in dire need of credit repair or those who are in a difficult financial situation.

Discover offers next-day loan

The Discover it Credit Card Secured is a great card to establish credit and make on-time payments. An applicant pays a one-time security fee, which can be refunded, and has free access to their credit score from the three major bureaus. If you meet certain criteria you may even be eligible for an upgrade to an unsecured card. Next-day loan options are also available so that you can make payments whenever it suits you.

You must make a $200 security deposit to be eligible for the Discover it Secured card. Once you are approved, your credit limit will be equal to the amount of the security deposit. This card allows you to have a credit limit up to $2,500. If you want, you can upgrade to a greater credit limit.

Discover offers platinum secured credit cards

The Platinum Same Day Secured Card Credit Card from Discover does NOT require a security deposits. It has no annual fee and earns 1% cash back on all purchases. This credit card is a great tool to rebuild or start from scratch. You can also use it to make card-not-present payments. Virtual credit cards are offered by many major credit card issuers. This allows you to use your card at any merchant, without having to present it.

This card offers great rewards and is an excellent option for those working to improve credit scores. The $200 deposit is all you need and the money will be returned after seven months of responsible spending. The rewards program is another great feature. This is a great way for you to improve your credit score if you have been declined for a regular card.