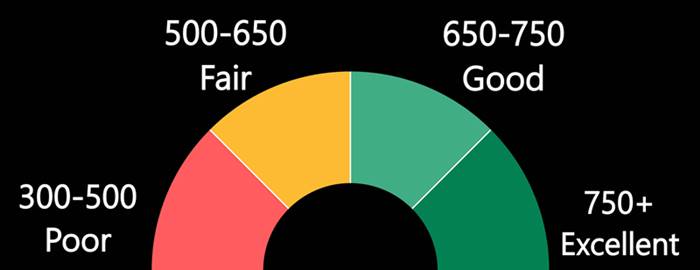

You're not the only person looking for ways of building credit. You need to raise your credit score to be able to access many important financial services. However, it can be confusing to know where you should start. There are several methods that will help you quickly build credit. These include making timely payments, applying to several credit cards and borrowing a loan in order to build credit.

Make on-time payments

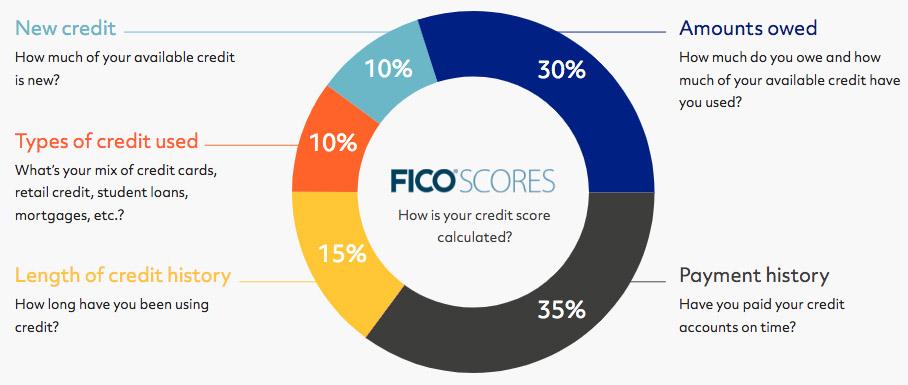

One of the most important factors in determining your credit score is your payment history. It accounts for 35 percent of your credit score, and it is therefore important to make on-time payments whenever possible. Automated payments are the best way to do this. They automatically debit your bank account from the due date. This means you don't need to remember to put aside extra money to pay the payment.

A small personal loan can be another way to build credit. This loan can be a great way to build your credit history, even though it may seem scary. You should only borrow what you are able to pay back. Don't forget to make timely and timely payments. This will cause your credit score to plummet.

A secured credit card

Secured credit cards are a great way to improve your credit score. You will need to make a cash deposit in order to secure this card. In return, you are allowed to use the card for purchases. The issuer can take your deposit if you are late paying.

Your credit score will rise quickly when you use a secured card. You can actually see your credit score rise quickly if your payments are on time and your balance is low. If your credit history is solid enough, you might be eligible for an unsecured card with lower fees or better rewards.

Multiple credit card applications

Whether you're building your credit from scratch or rebuilding your credit, applying for multiple credit cards can be an effective strategy. Credit card applications are similar in that they require identification information such as your date of birth or Social Security number. After that, you'll need to go through several stages including a credit screening. Here are some points to remember while applying for credit cards. First, provide as much detail as possible.

Multiple credit cards are a great way to increase your credit score. You might lose your credit score if there are too many inquiries and too high balances. Also, you might risk accumulating too much debt and end up with a higher utilization ratio than you can handle.

Take out a loan to improve credit

Many credit unions and banks offer loans for people trying to build credit. These loans must be reported to credit bureaus. This means that you shouldn't borrow more money than you can afford. It is also important that you make your monthly payments on time if you are trying to build your credit rating by taking out personal loans. A late or missed payment can cause credit scores to plummet.

A good credit score can make it easier to get new credit and get it at the best possible rates. Building your credit score can be tricky, but it's not impossible. It takes time to build credit. To keep your score high, it is important to be on top of everything and make timely payments.