Credit score can be improved by managing your credit cards well and paying your monthly balances in full. You should avoid interest charges on your balances, and pay more than the minimum payment. Your credit score will improve if you have a lower credit utilization. The CFPB recommends that your credit utilization should not exceed 30% of your total credit. This means that you should keep your credit utilization below 30% of your total credit limit. Multiple credit cards can be a great way to increase your total credit.

Multiple credit card accounts can improve your credit score

Having multiple credit cards can be a good thing for your credit score. Each card should be used responsibly. You must pay off your balance each month in full. This will ensure that you have a good credit rating and not incur interest charges. This will reduce your credit utilization ratio. According to CFPB, your credit limit should be less than 30%. For a $2,000 credit limit, that means your balances should not exceed $600

Multiple credit cards improves your credit score as lenders prefer to see a variety. This shows you can manage your borrowing. Some credit cards also offer rewards programs that allow you to earn cash back, or even travel benefits. In addition, having multiple credit cards can help you lower your debt to credit ratio, or CUR.

How to manage them effectively

Many lenders want to see that there are many credit cards available and that you manage your debt well. You will be able to manage multiple credit cards, which shows you are familiar with the terms and conditions. This is a sign that you know how to borrow responsibly. Multiple cards allow you to enjoy rewards programs and other perks. You can lower your debt-to-credit ratio (also known as your credit utilization rate) by managing more than one credit card.

It's not as hard as you might think to manage more than one credit card. The key is to keep up with your payments and keep track of balances. This will ensure that you're not accruing credit card debt, which can negatively affect your credit score. Be aware of the payment dates for each card. Failure to pay a bill on time can lead you to paying a higher interest rate and fees. It is better to pay your entire balance each month than the minimum.

Keeping spending in check

It is important to control your spending when you have multiple credit accounts. This will help you improve credit score. It is vital to pay the entire balance each month, and not allow it increase in size. This will ensure that interest rates are low. It is also important to keep your credit utilization to less that 30% of your total credit. You should limit your credit card balance to $600 if it has a $2,000 limit.

Lenders like to see a diverse range of credit accounts, and having multiple cards shows that you know how to manage your borrowing. Numerous credit cards also have unique rewards programs such as cashback, travel benefits, and other perks. A lot of credit cards will lower your debt to income ratio (also known by your credit utilization rate).

Repaying all outstanding balances each month

A good strategy to improve your credit score is to pay off all balances on multiple credit cards each month. Your overall utilization ratio, also known as credit utilization rate, is the second-most important factor that can affect your credit score. It will be easier to pay off your monthly balance. Moreover, you'll avoid interest charges because you'll avoid carrying a balance from one month to the next.

It's actually a good idea to pay your monthly credit card balances. By doing so, you can avoid late fees and interest as well improving your credit score. It will also help you keep your total balances low across all of your accounts. Your credit score will rise if you have lower balances. This will make it easier to get better terms.

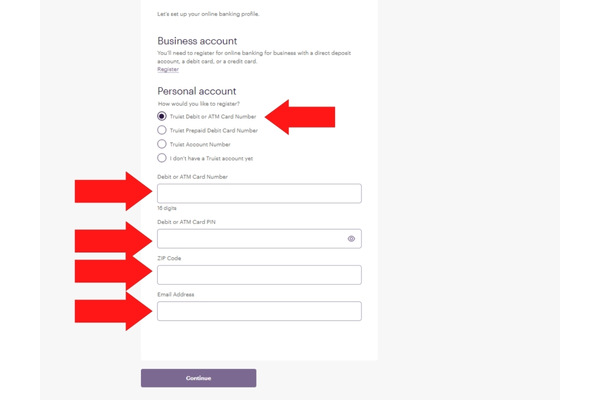

Multiple accounts may be opened at the same bank

It may surprise you, but multiple bank accounts won't affect your credit score. This is because your score is based on your credit accounts, not your bank account balances. Multiple bank accounts won't affect your score unless there are delinquent or inactive credit card accounts. However, opening multiple bank accounts can have a negative impact on your score if you have multiple hard inquiries on your credit report. This is because you are perceived as a risky customer.

While banks and credit unions allow multiple checking accounts, their minimum balance requirements can vary between institutions. Some institutions require that you maintain an account with a minimum balance, while others require that you have a minimum of $25 to avoid a monthly charge. You should avoid paying these monthly fees, especially for those with low income.