It's possible to be confused about how to fix your credit. If you have bad credit you may be able to ask a close friend or family member for a co-signer. This option comes with full responsibility and risk. They'll be responsible for loan repayments. However, be aware that you might be turned down for more credit because they have a bad credit history, so use this option with caution.

Pay off overdue bills

You must start paying off overdue bills to rebuild your credit rating. Paying on time is the largest factor that affects your credit score. Late payments can cause credit scores to drop by as much as seven and a half year. You should also be aware of your credit utilization. This is the sum of all your outstanding credit card and loan balances. Late payments are more important than paying on time.

Pay your bills on time to prevent a decrease in your credit score. For seven years, your credit report will reflect missed payments. If you want to rebuild your credit score you need to pay all outstanding debts as soon possible. To do this, you should make minimum payments to all of your accounts. Add extra payments to the highest APR debt, and then repeat the process for all other debts. Late payments can damage your credit score, so make sure you keep up with all past due payments.

Avoid late payments

Reexamining your credit report is a good way to avoid late payments and rebuilding credit. The credit bureaus can be contacted to dispute inaccurate information. It is quick and easy. It is fast and free. While it is tempting to make only the minimum monthly repayment, making a larger monthly payment will reduce interest fees.

Setting up automatic payments is one of the best methods to avoid late payment when rebuilding credit. If you don't have the money to pay your minimum monthly bill, setting up an automatic payment will give you the money needed to pay the minimum amount. So that your bill gets paid on time, make sure you set up automatic payment on all accounts. If you can't do this, you can also use multiple credit cards.

Secured cards can help you improve your credit score

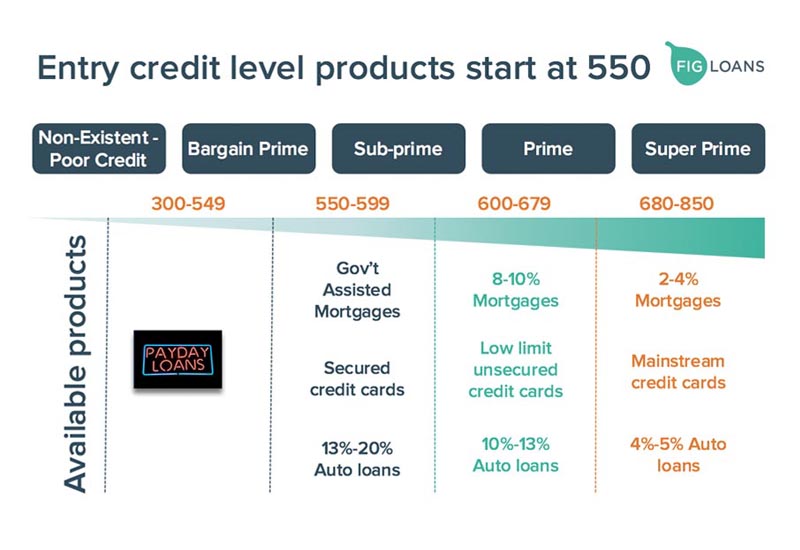

You might consider applying for a secured credit line if you are looking to raise your credit score. These cards can be used by people who are working on rebuilding their credit, but do not have the required credit score for traditional credit cards. Because of this, lenders view people with low credit scores as high risks and often require a cash deposit before approving them. This reduces the bank’s risk of defaulting and helps to keep the bank solvent.

Your credit score is based on many factors, including your payment history, length of credit history, and the types of credit you've used. Secured credit cards can help you build credit because they report your payment to the three main credit bureaus. On-time payments on your secured cards are the best way to build strong credit histories. Keep the balance low. You can still use your secured credit card to make everyday purchases. However, banks will consider you credit-hungry if you exceed your credit limit.

Be sure to pay off all medical debt before you rebuild your credit

Medical bills won't appear on your credit score, so it is important to pay them off before you start rebuilding your credit. You should be aware of a few things. These debts will not affect your credit score. Actually, hospitals will make very little money by selling your debts on to a collection agency. In such cases, hospitals are likely to work with patients to negotiate a payment plan and/or accept a part of your payment.

A major benefit of paying off your medical debt prior to rebuilding your credit rating is the reduction in your credit score. Although your credit report will show the negative mark, it will take longer for the marks to appear. You will also have the medical bills on your credit reports for seven years. That means that these debts will prevent you from getting loans and credit cards, and they will also make hiring decisions more difficult for you. Although medical bills might not appear on your credit report as an important item, they can have a significant impact on your credit score.